36+ Avalanche Debt Calculator

Web How to use this debt snowball vs. Heres a short instruction on how to use this debt avalanche calculator.

Debt Snowball Calculator Undebt It

Web To make a debt avalanche calculator it took me many dozens of hours of work to develop that initial Excel template and then it took many years of people using it.

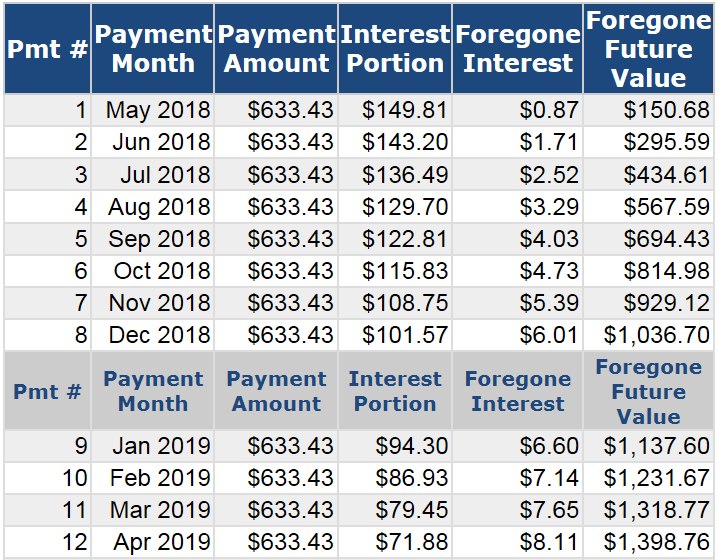

. The Avalanche method of paying off debt is seen as the absolute most efficient method possible and can be found in many professionally created Debt. Predict and visualize your balances over time tweak in real-time. An example of total amount paid on a personal loan of 10000 for a term of 36 months at a rate of 10.

Web Use our debt avalance calculator to find out how quickly you can pay off your debt with the lowest balance. This way youll reduce the total amount of interest you pay on. Lets find out which method is the best way to pay off debt for you.

Web In addition to those two payments you can afford to pay an extra 400 each month towards debt. Additionally it gives users the most cost-efficient payoff sequence with the option of. For the first step you need to set the.

Ad Best Debt Consolidation Company. Avalanche repayment methods is a common debate. For each debt you have enter.

Pay off your lowest balances first if there are two with the same balance pay off higher interest rate first. Compare Relief Plans Reduce What You Owe. Fill Out Our Form.

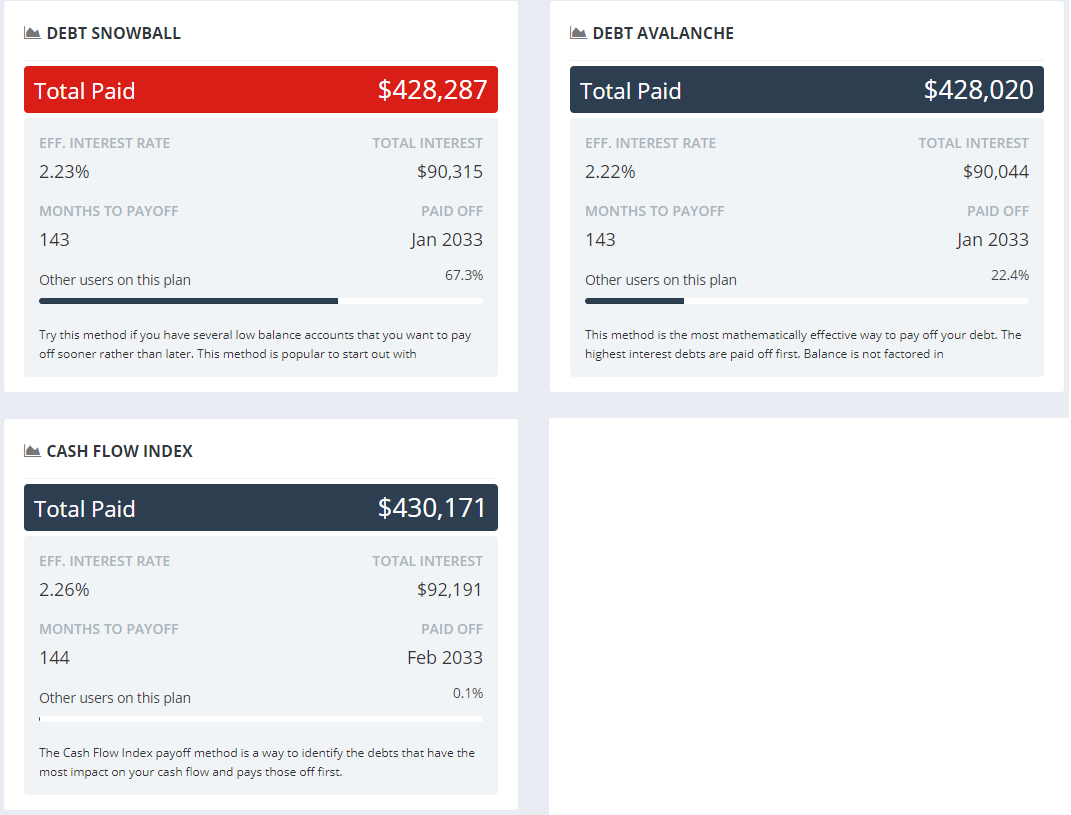

Web The Debt Snowball Method Lowest Balance. Plug in your debt details. Web Debt snowball vs.

Youll continue making minimum. Include your Debt Budget. In this case your total debt payoff budget is 900.

Web The calculator below estimates the amount of time required to pay back one or more debts. Web Using the Debt Avalanche Method you would make minimum payments on everything except for the Department Store Credit Card which has the interest rate of. Web How to use the Debt Avalanche Calculator.

Web The Debt Avalanche Calculator is a flexible tool that can help you compile your outstanding debts and figure out how much to repay on each in order to be debt-free in. Manage your debt. When a balance is paid in.

Web The debt avalanche method is a repayment strategy where you prioritize paying off your balances with the highest interest rates. Include all your debtsminus mortgage s if you have anywith the account types balances interest rates and minimum amount due each. Web In this avalanche debt method video we discuss exactly what the avalanche method is Why is avalanche better than snowball and also go over When would you u.

By using your bonus to. Web The debt avalanche method on the other hand focuses on paying off your debt with the highest interest rate first. Emergency Savings Accounts.

Get the Top Debt Solutions.

Debt Snowball Calculator Accelerated Debt Avalanche Payoff Planning Calculator

Using The Debt Avalanche Method Vs A Debt Snowball

Snowball Avalanche Calculator Magnifymoney

Avalanche Vs Snowball Which Debt Payoff Method Is Best

5k K Lnzqyodrm

Debt Avalanche Calculator Spreadsheet Google Sheets Blue Etsy

Debt Reduction Calculator Debt Snowball Calculator

Debt Reduction Calculator Tutorial Use A Debt Snowball To Pay Off Debt Youtube

Free Online Debt Snowball Avalanche Calculator Undebt It

Debt Avalanche Calculator Spreadsheet Google Sheets Blue Etsy

Debt Snowball Calculator Accelerated Debt Avalanche Payoff Planning Calculator

![]()

Debt Snowball Tpt

![]()

Debt Snowball Tpt

Debt Paydown Calculator Eliminate And Consolidate Debt Bankrate

The Debt Free Derby Debt Snowball Vs Debt Avalanche The Financial Freedom Project

Alchemy Dapp Store Discover Web3

Cash Flow Index Cfi Debt Payoff Method Undebt It Blog